New Budget Set For Public Hearing On July 8

When: Monday July 8, at 7PM

Where: Charlestown Elementary School

What: Public hearing on the revised 2019/2020 budget

At the June 17 Town Council meeting, the Council voted unanimously to send a revised FY2020 budget to public hearing on July 8. After the public hearing, a date will be set by the Town Council for another all day Financial Referendum.

The operating budget proposed is essentially unchanged, except that the $3.1 million fund that was to be set aside for a possible Community Center, which was to be contingent on majority citizen support in a town-wide survey and in public meetings, has been reallocated.

First, the amount to be raised from taxes is to be reduced by $1 million. This reduction would result in a small decrease in the tax rate. Further, approximately $2.1 million is to be transferred to the town’s reserves. Finally, approximately $75,000 is to be spent for a professional, town-wide survey.

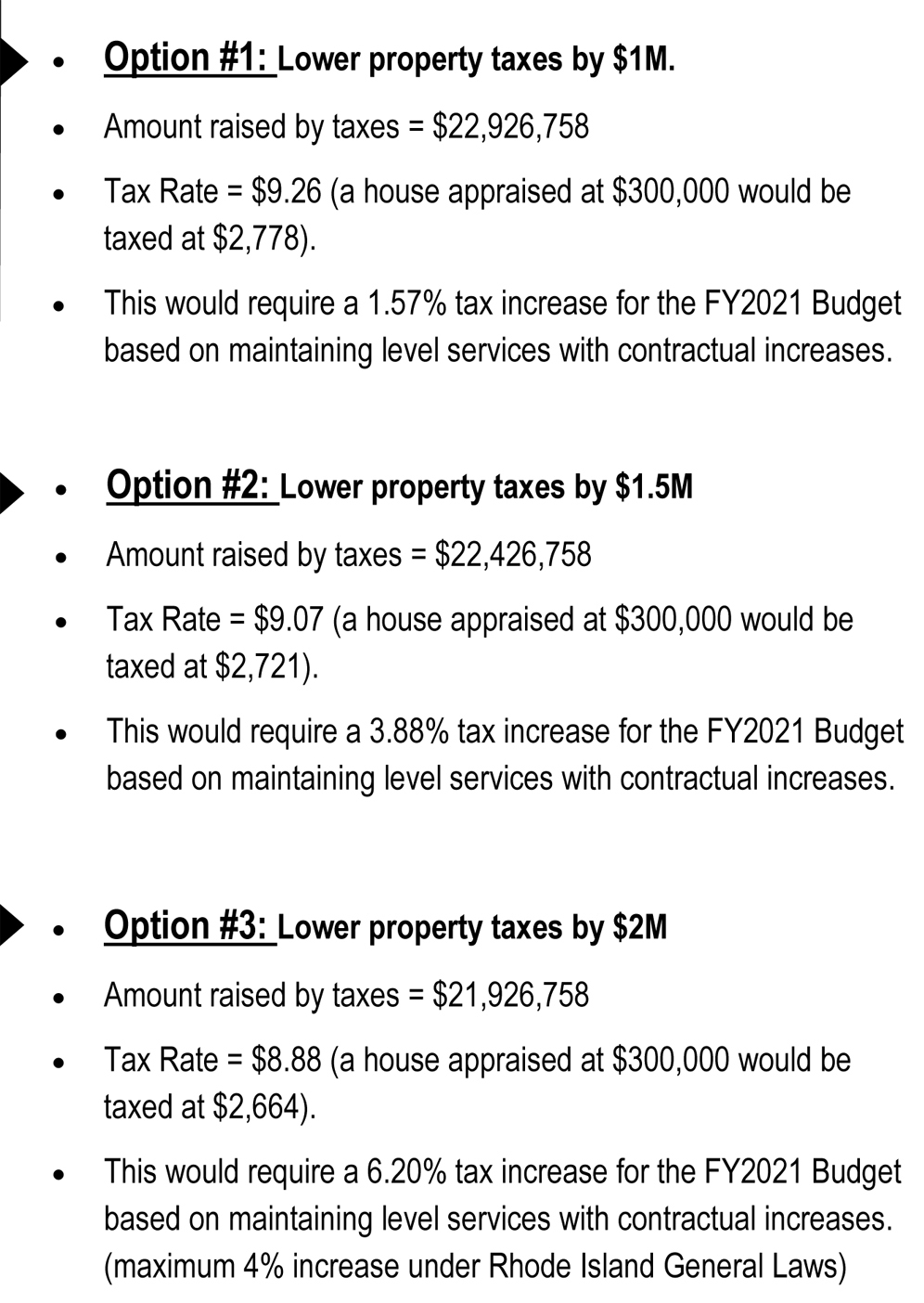

The Town Council was unanimous in its support for a decrease in the tax rate. At an earlier Council meeting, Town Councilor David Wilkinson had requested that Pat Anderson, Town Treasurer, prepare an analysis of the consequences of “returning” $1million, $1.5 million, or $2 million to the taxpayers. That analysis, including the effect on tax rates, is below.

The Town Council chose the first option as the most prudent. Choosing either of the other two options would result in reducing the amount raised below what is needed to run the town. In addition, the town is governed by state law that limits the increase in the amount that can be collected from taxes in any one year to 4%. The Council reasoned that a large reduction in one year would result in deficit spending that might take between two to four years of tax increases to work out of.

If the Chariho enrollment remains low next year and the contracted 3% increases in pay raises to town employees and police can be accommodated in the budget, the town may be able to continue with the reduction in the tax rate. If the enrollment rises as a result of new subdivisions that are now under construction or if other needs arise, the tax rate could be increased by a small amount next year. Spreading the tax reduction over two or more years seemed the most prudent of the three choices outlined by the treasurer.

Speaking in favor of a tax reduction were Charlestown Citizens Alliance (CCA) President Leo Mainelli and CCA Steering Committee member Tom Gentz. Those opposed to the tax reduction included Charlestown Residents United (CRU) Treasurer Ken Robbins. Mr. Robbins and others thought the money might be needed for a large project. Leo Mainelli, Tom Gentz and all the Town Council members noted that the most common statement from those who voted in the Financial Referendum on June 3 was that they wanted the one-time surplus back in the form of a tax reduction. Mainelli, Gentz and the entire Town Council felt that this common request from the referendum voters needed to be honored.

June 30, 2019 @ 3:38 pm

There is more to budget development than creating an annual operating budget. Strategic budgeting that projects the needs of the town in the short term future is a logical extension of the decisions made for past budgets. Essentially, budgeting is a progression of decisions and accomplishments over a longer term than exhibited through an annual snapshot of town spending needs. If we look at one year as a standalone view, we ignore the projected needs of the town in the future.

June 28, 2019 @ 2:46 pm

Hello all:

I wish to point out that the figures above are somewhat misleading in that the budget is determined for each town fiscal year based upon the needs for that year. The existence of the $3.1 million surplus under discussion here is unrelated to the town’s needs for each year. By presenting the figures as shown above it gives the appearance that the budget will be increasing substantially in the out years. This is of course simply an artifact of the procedure for distributing this surplus back to the taxpayers through a “tax reduction”. By lowering the tax rate in the budget year that in itself does not increase the needs of the town in the following years. Thus the “budget Increases” in the out years are simply returning the funds needed from taxes back to the pre-surplus levels, and hence an artificial “tax increase”.

I recommend the following:

1. The town should look for ways to return the entire $3.1 Million surplus to the taxpayers, minus the funding needed for this so called “professional survey”, if that is deemed to be necessary.

2. If the requirement to stay within the 4% is applicable to this unusual situation then the town should look to spread the return of the $3.1 M surplus over two or even three years to the taxpayers.

3. The council should pursue all avenues for the return of the $3.1 million surplus to the taxpayers.

Regards

Richard H. Messier, PhD